Taxes are due April 15th!

File today to get your biggest possible refund.

Here’s what our customers are saying

4.8 | 937.3K Reviews

SWITCH TO TURBOTAX

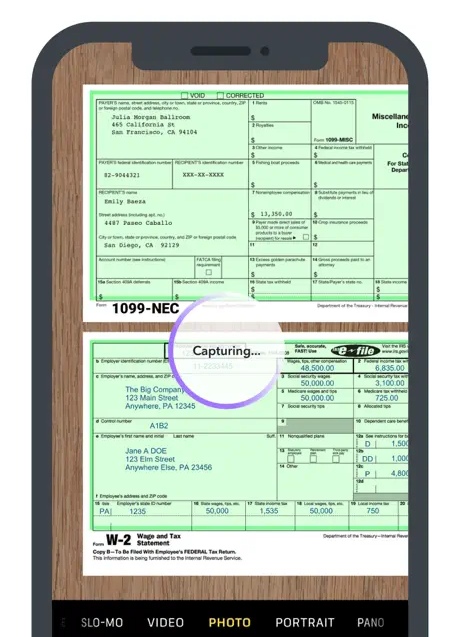

Switch to TurboTax, do it yourself and file for free on the app by 2/28. See offer details

Get your taxes done right and your biggest tax refund—guaranteed

Your tax return, backed for lifeTM

100% accurate calculations, audit support, and your max refund. All backed for the full 7-year life of your tax return.

Your best tax outcome

Whether you file yourself or get expert help, you’ll get your maximum refund guaranteed, or your money back.

Taxes done right

TurboTax calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.